Don't let common problems stop you from filing your taxes!

How to deal with 3 common problems that make it harder to file your taxes

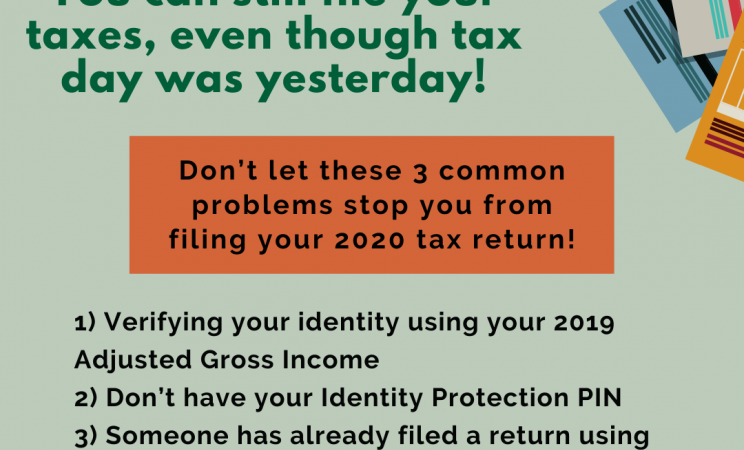

If you haven’t yet filed your 2020 tax return, you can still do so, even though they were due yesterday, and it is recommended that you file electronically. You can still get help from Campaign for Working Families to file your return for free: https://cwfphilly.org/

It is very important to have a return on file with all of your child dependents, even if you didn’t have any income in 2020, because the IRS needs that information to be able to start issuing you the advance child tax credit in July this year. But, if you are running into problems electronically filing your 2020 return, and getting error messages saying your return wasn’t accepted, here are some possible solutions.

You may need to know your 2019 adjusted gross income (AGI, Line 8b on your 2019 return) to verify your identity when e-filing your 2020 return. But, if your 2019 tax return hasn’t yet been processed, then you will have to enter $0 instead of your actual 2019 AGI. Or, if you used the non-filer portal to claim the stimulus payments last year, you’ll need to enter $1 as your 2019 AGI.

If the IRS issued you an Identity Protection PIN (an IPPIN), you won’t be able to e-file without it. Some people can retrieve their IPPIN online or get the IRS to re-send the IPPIN through the mail https://www.irs.gov/identity-theft-fraud-scams/retrieve-your-ip-pin . But, if you were issued an IPPIN and you can’t retrieve it, you will have to print out your return and sign and date and mail it in to the IRS. We recommend making a photocopy or scan of your signed tax return before mailing it, and to mail it certified mail to have the tracking number and postmark as proof of having mailed it in.

If you try to e-file your return and you get a message that your return wasn’t accepted because a return has already been filed using either your or one of your dependent’s social security numbers, then you will also have to print out your return and sign and date and mail it in to the IRS. Basically, if this happens, it could be because you are the victim of identity theft or someone else is claiming your dependents. This is the type of situation we can help with, so feel free to contact us to request assistance if it is happening to you.

IRS Delays

If you have to mail your 2020 tax return in, it will probably take a bit longer for the IRS to process than if you were able to e-file. But even for people who did e-file, if you haven’t yet received your refund, the delay could be because the IRS didn’t have time to figure out how to program its computers to handle two specific situations:

Delay situation #1: If you used your 2019 earned income to calculate your 2020 Earned Income Tax Credit and/or the Additional Child Tax Credit, the IRS needs to have a person look up your 2019 tax return to make sure what you put on your 2020 return is correct. If Lines 27 or 28 of your tax return say “PYEI” on the dotted line, then this applies to your return.

Delay situation #2: If you claimed the Recovery Rebate Credit (Line 30 of your tax return) to get whatever part of the 1st or 2nd stimulus payments that you didn’t already get automatically, and the amount you claimed is different than what the IRS computers calculate, then the IRS also needs to have a person review your return and the stimulus payments that you already received.

The IRS is talking about between 6 and 8 million 2020 tax returns being delayed for these two reasons, but there could be other causes of delay, too, including cases of suspected identity theft or if an employer didn’t correctly file a Form W-2 with the government.